Deliver the best UX

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Empower your app with clear transaction history and provide the merchant's accurate name and logo, payment category, GPS location, and other useful merchant information for each transaction.

Would you use and trust an app that mystifies you with the information it displays? Probably not, and neither would your clients. Change that by turning confusing information into actionable insights with enhanced data.

Strengthen your credibility by accurately portraying how you manage users’ finances. Improved NPS, app ratings, and overall engagement will attract new loyal customers.

Reduce the cost of dealing with chargebacks by ensuring that clients know exactly what they are paying for and have no reason to claim their payments.

Motivate card holders to make more frequent card payments by delivering a clear and insightfull overview of their payments and finances.

Build high-value features for your app and give users a reason to use it every day.

Bring clarity from the start with accurate and country localised merchant name

Take advantage of a database of over 44k unique high quality logos respecting brand guidelines of merchants.

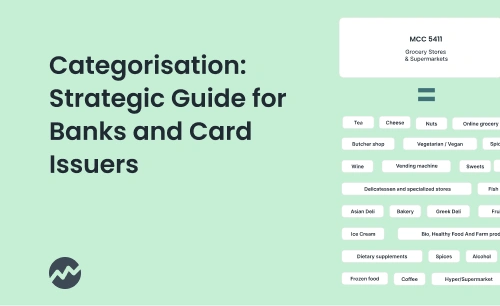

Tag and segment individual transactions to give users deep insight into their personal finances.

Paypal is not the actual merchant your customers are buying from. Let your customers know who they are really paying.

We recognise 65+ payment gateways and methods.

Provide users with seamless access to merchants, whether they are simply ordering pizza or contacting customer support.

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

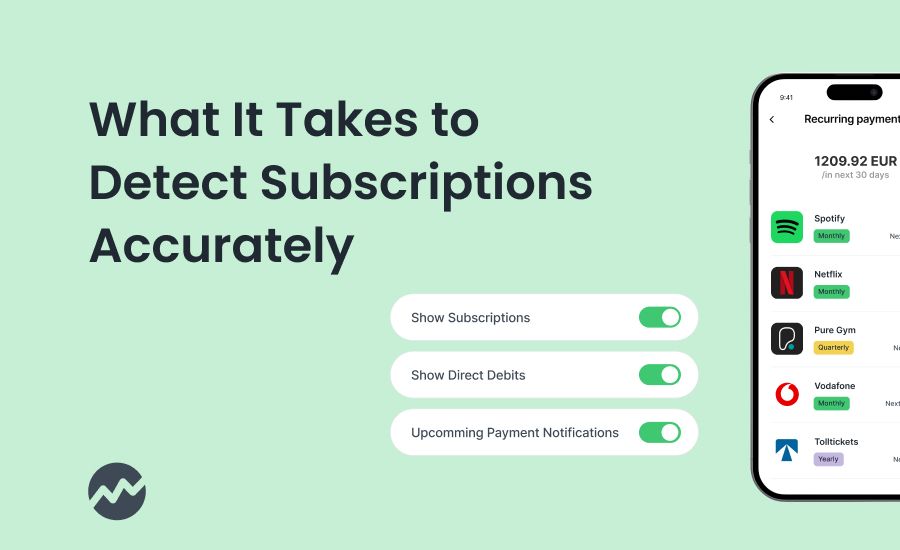

Recognise recurring payments, subscriptions, or direct debits for control and predictability.

Meet all the requirements of AN 4569 Revised Standard

Provide the best possible experience to clients when searching for a place to withdraw money

.jpg)

Explore how Tapix can help you get the most from transaction data, increase your app engagement and turn UX into your competitive advantage.