Deliver the best UX

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Empower your ATM finder feature with withdrawal fees and useful information such as clear name, logo, distance to destination and labels regardless of provider.

The world might be becoming more digital by the day, yet in many countries across the globe, there are still around 3.5 million ATMs in operation. In many places, cash payments remain essential and are still considered the main way to pay.

Tapix ATM Nearby™ is here to enhance the experience when users discover unknown places and search for a way to withdraw money in times of need.

Save money of your clients and avoid their frustration by uncovering (hidden) extra fees incurred by ATM owner they might not expect.

Stay ahead of the competition and boost your app's attractiveness. Enable clients to see ATMs in the area regardless of provider.

Can your chatbot answer a simple question: Where is the closest ATM? With our ATM locator API it becomes a trivial task.

Once integrated, you don't have to manage any data changes - Tapix does it all for you

ATM fees are biting harder than ever. The average total fee a customer pays for an out-of-network ATM transaction rose to $4.73, a record high, Bankrate found, based on data from non-interest and interest accounts. $3.15, with the average fee the customer’s own bank charges the customer for the out-of-network transaction, $1.58.

Show that you truly care about your clients' money by transparently displaying withdrawal fees at all ATMs (not just yours).

*ATM fee identification uncovers additional fees incurred by ATM owner. It does not reflect your own fees, and client’s product packages and past behaviour e.g. first two withdrawals per month are free, etc.

Boost the positive experience even further with additional useful information on the ATM´s displayed

Show ATM information in similar look and feel as clients see their transaction in payment history (including past ATM withdrawals)

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Fuel digital transactions with accurate merchant insights

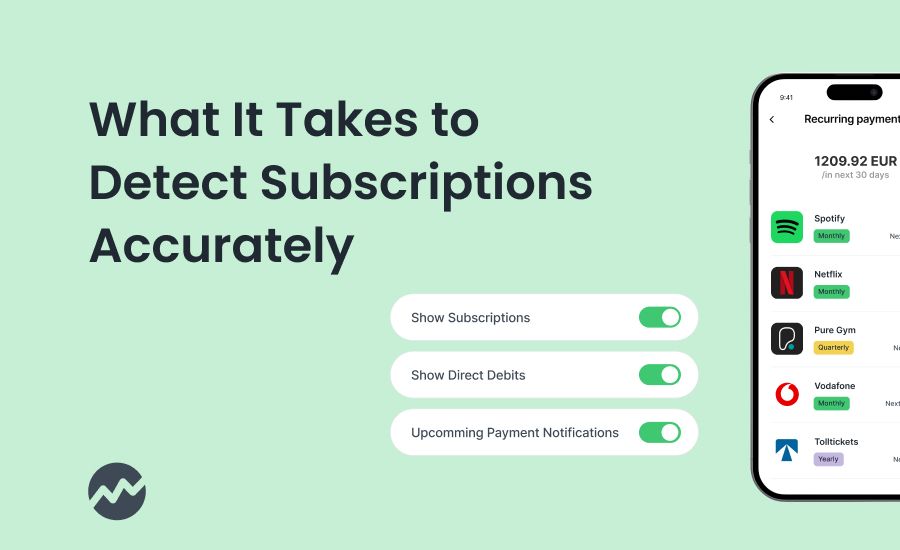

Recognise recurring payments, subscriptions, or direct debits for control and predictability.

Meet all the requirements of AN 4569 Revised Standard

Explore how Tapix can help you get the most from transaction data, increase your app engagement and turn UX into your competitive advantage.