.jpg)

Product insights

How Subscription Management, Data, and Recurring Payments Drive Customer Lifetime Value

Subscription management used to be simple. You paid monthly for entertainment, maybe a gym membership, and that was the end of it. Now it’s everything. You don’t stick with a bank because the logo feels comforting or the branch is on your street. You stick because the bank becomes the default place where your financial routine works. Salary comes in. The same bills go out. The same services are renewed. After a month, your account turns into a quiet system that runs your life in the background.

Product insights

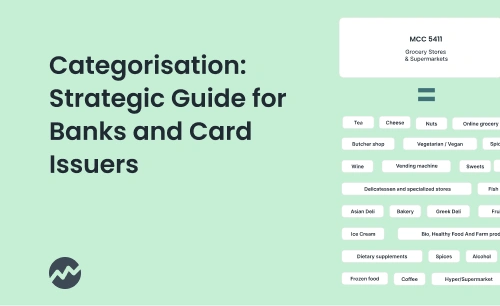

Financial Transaction Classification Categories: A Strategic Guide for Banks and Card Issuers

For banks, digital banks, and credit card companies, accurate transaction categorisation sits at the core of customer experience, analytics, compliance, and revenue optimisation. As consumers expect real-time insights and regulators demand clearer reporting, classification quality and proper transaction classification categories have become a competitive differentiator.

Industry insights

Top digital banking and fintech influencers to learn from

The fintech industry can be a crowded place. As it continues to grow and evolve, staying updated on the latest trends and innovations becomes more important than ever. LinkedIn is a goldmine for discovering influential thought leaders who provide valuable insights, news, and ideas that shape the sector.

Industry insights

What Is the Top 10 Digital Banking Trends to Look Out For in 2026?

Digital banking in 2026 will be defined by tighter regulation, higher UX expectations, cleaner data structures, and the slow disappearance of card-centric logic. Banks that treat data quality and transaction clarity as their core product layer move faster than institutions that still operate through legacy feeds and fragmented interfaces.

Industry insights

Top 135+ Fintech Conferences of 2026: Must-Attend Events for Industry Insights

Fintech and digital banking event lists exist, but they are often fragmented, incomplete, or hard to compare. Relevant conferences are spread across multiple sources with little structure. This curated overview brings them together in one place for 2026.

Product insights

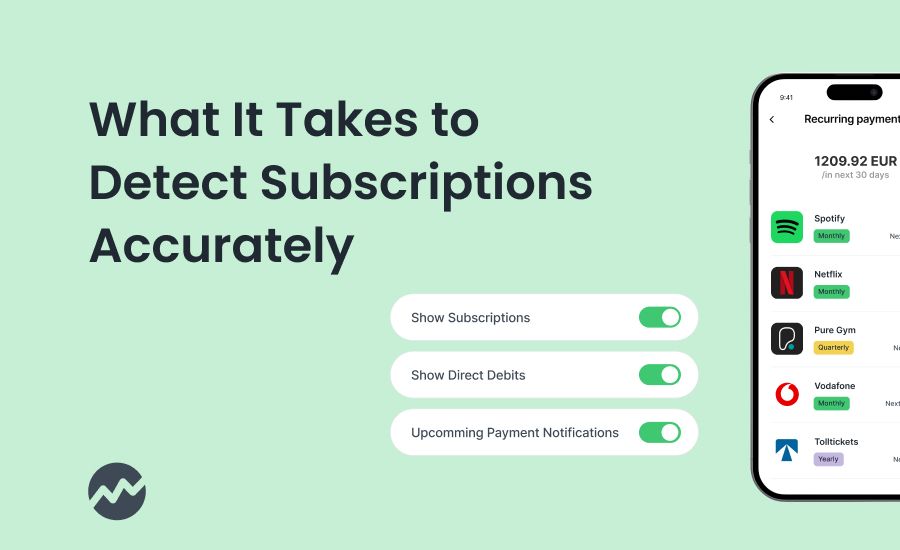

Detection Solutions for Subscriptions: What Accurate Identification Really Requires

Short answer: accurate transaction data. Long answer: accurate transaction data plus the ability to treat different payment behaviours as different problems. That is the core of any true detection solution when it comes to subscriptions. Most banking apps still process transactions as one big, flat stream. But in real life, customers experience spending in three distinct ways...

Industry insights

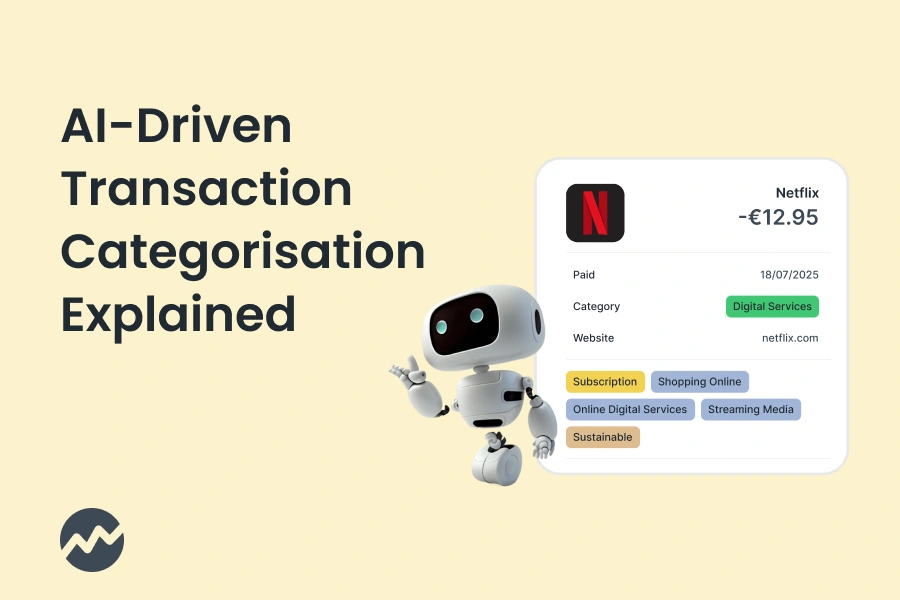

Transaction Enhancement Services: AI-Driven Categorisation Explained

Transaction enhancement services increasingly rely on AI and machine learning to automatically categorise transactions, enrich merchant data, and normalise transaction descriptions. These services analyse transaction strings, merchant identifiers, MCCs, geolocation, and historical behavior to assign accurate categories. AI-driven categorisation improves accuracy compared to rules-based systems and is widely adopted by banks, fintechs, and expense platforms to power insights, budgeting tools, fraud detection, and reporting.

Product insights

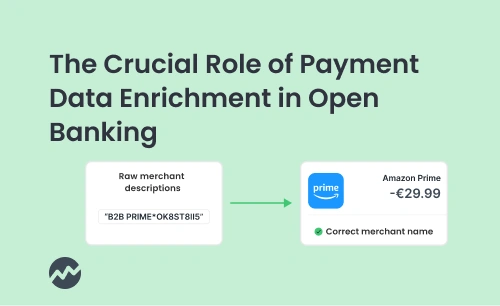

Turning Enriched Payment Information into Real Value for Banks

Enriched Payment Information works for banks and customers alike. By transforming unclear transaction codes into meaningful insights, banks earn customer trust, reduce costs, and build engagement that lasts. This technology turns a banking app into a smart financial companion that guides customers and strengthens loyalty.

Product insights

Unlocking Efficiency and Cost Savings with Payment Data Enhancement

Today, Payment Data Enhancement is integrated into almost all strategic operations. By ensuring that every transaction is accurate, complete, and intelligently validated, organisations can scale payments efficiently, reduce operational costs, and improve customer experience.

Product insights

Unique Data Points and APIs Behind Different Bank Transaction Types

Raw card data has always been half measure. You can barely read the merchant, the MCC looks “fine-ish,” and context is missing. Enrichment APIs fix that. They turn noisy payment strings into readable stories - complete with merchant identity, category, channel, location, and recurring or refund signals. The faster this happens, the better the experience for all bank transaction types. Every second of latency is a lost moment to reassure, reward, or retain a customer.

%20(1).webp)

Product insights

Improve Fraud Detection with Enriched Payment Insights

In banking, risk management is only as strong as the data it relies on. Yet most organisations still work with cryptic, incomplete, or inconsistent payment records - making fraud detection, credit scoring, and compliance unnecessarily complex. This is where payment data enhancement tools for risk management come into play.

Product insights

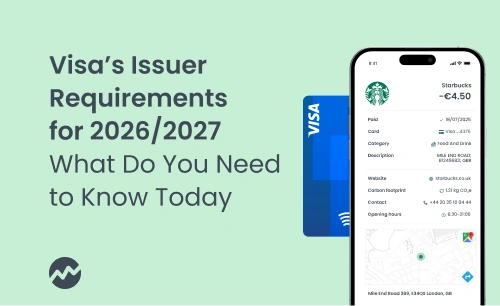

Visa Requirements to Provide Enhanced Merchant Data to Cardholders

Visa has announced a series of mandates updating how banks and fintechs manage transaction data, cardholder controls, and recurring payments. The changes follow similar regulatory steps taken by Mastercard and aim to improve transparency, consumer trust, and digital control in the European payment ecosystem.

Product insights

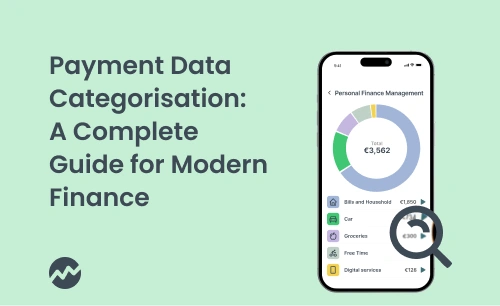

Payment Data Categorisation: A Complete Guide for Modern Finance

Every payment tells a story, but unclear codes and cryptic abbreviations often hide it. This lack of clarity leads to frustration, higher support costs, and missed opportunities. Payment data categorisation transforms messy data into structured, actionable insights, paving the way for better customer experiences and innovative financial products.

Industry insights

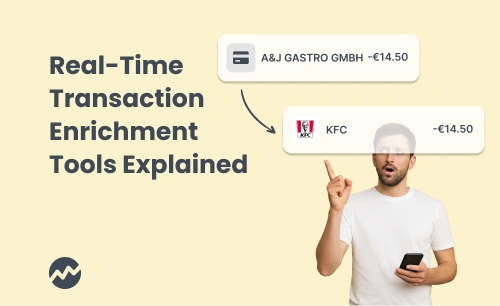

Real-Time Transaction Enrichment Tools: Key Questions Answered

Transaction data is only valuable when it’s clear and usable. It helps banks and fintechs transform raw payment strings into meaningful insights customers can instantly recognise - improving trust, experience, and engagement. Let’s dive deeper.

Success stories

One Partner, Better Data: OTP Bank Switches to Tapix for Enriched Data

OTP Bank, Hungary’s leading bank and the headquarters of OTP Group, serves millions of customers across Central and Eastern Europe. At this scale, consolidating providers and ensuring consistent data quality is key to delivering a seamless digital banking experience.

Product insights

Hyper-Personalised Banking Communication: Turning Real-Time Data into Relevant Conversations

Most people can tell when a message wasn’t meant for them. A generic “We’ve got a great offer for you” is easy to ignore. Messages that react to what a person is actually doing - this week, this morning, sometimes this minute - feel different. They feel helpful.

Industry insights

Beyond Banking: Bridging Payments, Play and Personalisation

Banking is stretching its legs. Its main mission might still be balances and bills, but it’s also phones, travel data, game culture, groceries, even sports pits. In Europe, the most interesting shifts are practical, a little playful, and surprisingly useful.

Success stories

5 Ways How Leading Banks Use Banking Transaction Enrichment

When banks treat transaction enrichment as an afterthought, everything downstream breaks. Spending insights? Generic at best. Carbon footprint? Ballpark. Compliance? Painful. Disputes? Endless. And every product manager knows the domino effect: low data trust means disengaged users, low NPS, and higher churn.

Industry insights

The Hidden Costs of Building In-House Data Enrichment Solutions

On paper, building your own data enrichment solutions sounds smart. You’ve got capable engineers, a decent data science team, and a roadmap that seems to allow for it. But here's the thing: enriching transaction data isn’t just a technical project, it’s a constantly evolving project. And for many banks and fintechs, what starts as a quick fix turns into a long-term liability.

Industry insights

How are Digital Banking APIs Transforming Finance in 2025

As banking gets more digital, the need for simplification and automation is becoming more apparent. A significant part of that leads to the adoption of APIs in banking. While APIs (Application Programming Interfaces) have been here for a long time, the current surge in digital banking is driven by the demand for real-time payment solutions, advances in open banking regulations, and the necessity for enhanced customer engagement.

Industry insights

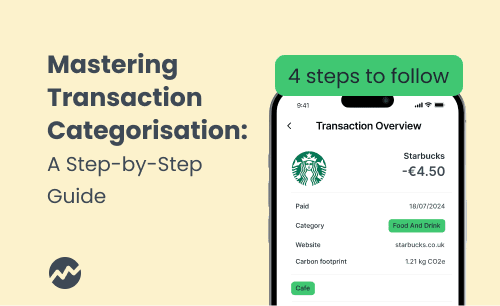

How to Categorise Transactions: A Step-by-Step Guide

If you've ever looked at a bank statement and seen chaotic strings of data, you’re not alone. Customers expect clarity. They want to know what they spent, where, and on what. On the other hand, the backend needs to know how to handle data correctly so both sides are happy.

.png)

Product insights

How Smarter Transaction Categorisation Opens the Door to Better Banking

The way we handle financial transactions has evolved significantly. Contactless payments, mobile wallets, and digital-only banking apps have redefined what it means to manage money. Despite all the technological progress, many banks still struggle in one important area: categorising transactions effectively. This is essential for almost every digital banking service.

Industry insights

Transaction Enrichment API: Best Practices and Common Pitfalls

We’ve covered transaction enrichment in detail before - how raw, chaotic payment data gets cleaned up and made meaningful. But this time, we’re looking at it from a different perspective. If you’re planning to integrate an enrichment API into your business or just want to know how API works in the context of digital banking, this article will be your guide.

Success stories

Deblock x Tapix: Millions of Transactions Enriched in Under 30 Days

Deblock, founded by Revolut alumni and based between London and Lille, is creating a new kind of account — combining traditional banking features with a non-custodial crypto wallet. With full EEA coverage and a newly secured banking license, the company is scaling fast.

Product insights

Getting to Know Payment Data Enrichment in Banking: Why It’s Essential

Tracking financial flows is one of the key elements of banking, and payment data enrichment is becoming an increasingly important tool for banks to improve their services and minimise risk. In this article, we look at why it is so important in banking and how to choose a transaction data enrichment API.

Inside Dateio

From Intern to Product Lead: How Kateřina Linhartová Helps Banks Track Carbon Footprints in Their Apps

She wanted to work in a startup and change the world around her. The idea took root during her Erasmus exchange in Finland, which she joined while studying at the Prague University of Economics and Business. Still a student at the time, Kateřina Linhartová joined the fintech company Dateio as an intern.

Product insights

Why is Transaction Data Enrichment Important for Digital Banking?

Enhancing transaction data is essential because it helps the customers know more about their transactions through insights and additional data, which helps them make smart decisions about their financial lives and build trust with their bank, who becomes their financial partner on the life journey.

Product insights

Why Merchant Name and Logo in Digital Banking Matter More Than You Think

You’re scrolling through your bank app, trying to remember what that $33 charge was. The line says “ESO PETROL TURDA DEP”. Was that lunch? A carsharing? Did someone clone your card? You tap. You Google it. Eventually, you give up - or worse, call customer service.

Product insights

Why Hyper-Personalisation Now Defines Success in Digital Banking

Customer expectations in digital banking have evolved pretty significantly in recent years. Gone are the days when "Good morning, Alex" and a templated savings suggestion felt impressive. Today, consumers want more. They want to feel understood - not just as account holders, but as real people with complex financial habits, ambitions, and anxieties. Time for hyper-personalisation.

Success stories

How to Build a Bank From Scratch: Behind the Scenes of Partners Banka Launch

Launching a digital bank involves navigating regulatory complexities, making critical technology decisions, and prioritizing customer-centric innovation. Partners Banka, established in the Czech Republic in December 2020, provides practical insights into this challenging yet rewarding journey.

Product insights

Payment Data Enhancement: How to Select the Right Data Enrichment Providers for Your Business

Data is the key to understanding the customer and the long-term success of any business, so it's no wonder it's a sought-after commodity. Accurate and detailed data not only unlocks the door to further business growth, but also increases customer satisfaction.

Industry insights

Responsible Banking Done Right: The Top 5 Banks and How They Lead

In recent years, more and more banks and financial institutions focus on sustainability as a core component of their operations. This shift towards responsible banking (also known as ethical banking) is mostly a response to the pressing global challenges of climate change, social inequality, and environmental degradation.

Product insights

How to Detect Gambling Transactions in Digital Banking

It often starts small. A customer moves money into their Skrill account - nothing unusual. Just a simple transaction in the background of an otherwise quiet banking day. But hours later, that same payment is funnelled into an online casino, masked by a generic merchant category code.

Success stories

How Raiffeisenbank Czech Republic displays the transactional carbon footprint of more than 1M+ clients with Tapix

Raiffeisenbank in the Czech Republic has been working with Tapix for five years to improve transaction categorisation, merchant recognition and payment enrichment. At a time when sustainability is an important topic for banks and consumers, Raiffeisenbank has integrated the Eco Track™ product to offer a view of the estimated transactional carbon footprint of payments to more than 1 million customers who actively use mobile banking.

Product insights

From Raw Data to Insights with Financial Data Enrichment

In today’s fintech era, it’s crucial to understand how we can use our customers’ data to make better decisions and understand their needs more deeply. But how exactly can we use this data, what types of data do we have and what can we get out of it?

Product insights

Recurring Payments in Digital Banking: How to Go From Chaos to Clarity

The more digital we become, the more online services, subscriptions and recurring payments we need to keep track of, as they become integral part of our daily lives. From streaming platforms and cloud storages to monthly fitness memberships and car payments, these automated transactions offer convenience, but at the price. Without accurate transaction data presented in a user-friendly way, managing them becomes a financial challenge - both for consumers and banking institutions.

Industry insights

Mobile Banking Innovations: The Role of UX & UI in Next-Gen Digital Banking

The financial industry has undergone a pretty radical transformation in the last decade, with mobile banking becoming a primary interface between banks and their customers. As highlighted by recent research from Branch, the mobile app industry has been seeing significant growth during the past several years and this trend extends to the financial sector.

Industry insights

Cracking the Code: The ABCs of Transactional Data Enrichment

Have you ever been in a meeting or conference, nodding along as industry experts toss around terms and abbreviations that sound like a foreign language? It can feel overwhelming, especially in the financial world, where terms and slang evolves fast.

Industry insights

Better Banking App: How To Increase Active Users in 6 Effective Ways

Banks have good reasons to encourage customers to use their mobile apps more often. First, it helps them make more money by offering products and services directly in the app. Second, it improves the customer experience - for example, by showing clearer payment information - and helps the bank work more efficiently.

Industry insights

Beyond MCC Codes: Why Accurate Transaction Categorisation Is the Future of Banking

Merchant Category Codes (MCCs), initially designed as a universal standard for categorising transactions, have long been the baseline for transaction classification in banking. However, their limitations have created challenges that resonate across banking operations, customer experience, and sustainability initiatives.

Industry insights

From enemies to allies: The Cooperation Between Banks and Fintechs

This gathering of experts and professionals not only provided a valuable opportunity for us to learn about the latest trends and developments within the industry but most importantly, our Head of Partnerships, Simon Koci, had a chance to host and moderate a panel discussion on the topic of Cooperation Between Banks and Fintechs.

Industry insights

How Data Shapes the Future of Banking UX

User experience (UX) today goes beyond a nice-looking interface or a conveniently usable application; it is about making data actionable, intuitive, and applicable in whatever interaction is made by the user.

Product insights

How Banks Should Work with Transaction Data

For any digital banking platform to work well, transaction data needs to go beyond a simple list of payments. After all, if you can’t do the most important thing right, the rest doesn’t really make sense. Modern customers expect their financial institutions to provide clear, contextual, and visually engaging transaction details that make understanding their finances simple. Let’s explore the crucial data points and features that shape top-tier transaction details in digital banking and transform raw data into meaningful financial insights.

Industry insights

Top 5 SME Banking Trends Shaping Digital Services in 2025

As we at SME Banking Club discuss topics connected with the digitalisation of SME banking on an everyday basis – during our webinars, publications on the websites, and interviews, in this article, I summarise the main subjects leading banks in the CEE region are thinking about right now.

Success stories

From Google to Revolut: Mariia Lukash on Driving Digital Banking Growth in CEE

Today, I had the pleasure of sitting down with Mariia Lukash, Revolut’s Head of Growth for CEE - a true powerhouse in fintech with over six years of experience in digital strategy and growth. After an impressive five years at Google, where she managed portfolios for major global fintech clients, she now leads Revolut's expansion across the region.

Product insights

The Cost of Data Inaccuracy in Digital Banking

With technology slowly progressing, data is starting to be at the heart of every transaction, decision, and strategy within banking. Whether it’s recommending financial products to users or automating decision-making processes, banks rely on data to understand their customers and provide a seamless experience. But what happens when the data is inaccurate?

.png)

Industry insights

Biggest Myths in Digital Banking Busted

Digital banking has advanced considerably, but like in any other industry, many myths and misconceptions are floating around. These often cloud understanding and limit the adoption of new technologies and ways to level up digital banking.

Industry insights

Top 5 Digital Banking Features for Generation Z

With technology moving forward faster and faster every day, digital banking is becoming the new main way we interact with our finances. And Gen Z is setting the pace. Born into a digital age, Gen Z demands more from their banking experience than ever before. Let's take a deep dive into the top 5 most used and demanded digital bank features and how is modern financial sector adapting to the needs of the new generation of users.

Inside Dateio

6 reasons to work in the Dateio data team

Our data team leader Adam highlighted 6 reasons to work at Dateio. There is no easy one-size-fits-all solution to our problem. It's not about being given a clear brief and having a process to get there.

Industry insights

8 Strategies to Boost Customer Digital Engagement in Banking

Maintaining customer loyalty has always been and should always be a key priority for financial institutions. With many banks offering similar services and rates, it is imperative to differentiate yourself by creating a unique and satisfying experience tailored to your customers.

Industry insights

Account Openers to Profit: A Guide for Banks

Today, the financial world is all about mobile-first convenience. Opening a new account has never been easier. Yet, while an efficient account-opening process gets your foot in the door, it doesn't guarantee a meaningful and, most importantly, long-lasting relationship. The real challenge lies in ensuring that new customers don’t just open an account and fade into inactivity but instead evolve into loyal, profitable clients.

Success stories

10 Questions with Michal Plzák: How Raiffeisenbank Leads in Digital Banking

Digital banking is more than just keeping up with technology—it's about understanding what customers need and delivering real value. Michal Plzák, Head of Digital Banking at Raiffeisenbank Czech Republic, has been doing just that for over 20 years.

Product insights

The Role of Financial Data Enrichment in PFM Tools

Personal Finance Management is designed to help consumers track their spending, set budgets, and achieve their financial goals, but in the past years, it has become much more than that. Digital banks like bunq or Tomorrow are starting to offer additional features to help customers see how their spending affects the environment around them. We are talking about checking your carbon footprint with a breakdown of spending categories, savings pockets or category restrictions for better control of your finances.

Industry insights

Key Features of Digital Banks: Insights from a Leading Fintech Expert

I’m Ondřej Machač, a FinTech enthusiast with a passion for pushing the boundaries of financial technology. I currently manage over 15 bank accounts across the EU, constantly testing them to stay on top of the latest trends in banking and fintech. I regularly share my insights in Fintree, the largest FinTech magazine in the Czech Republic, which I founded. Additionally, I work at Roger, one of the largest Czech fintech companies, which closely collaborates with banks.

Industry insights

11 UX Laws in Digital Banking

User experience (UX) in digital banking isn't merely about good aesthetics. It's deeply rooted in science and psychology, governed by established laws that guide user interactions and decision-making. Here are 11 key UX laws, explained with examples relevant to digital banking applications.

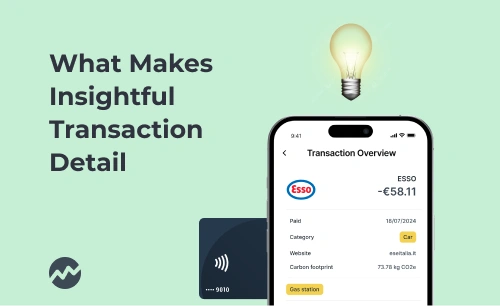

Product insights

What Makes Insightful Transaction Detail in Banking

Today, convenience and instant access to information is what makes or breaks the service. Banking has transitioned from paper statements and bank tellers to seamless digital experiences. A bank's primary touchpoint with its customers is through transaction detail – a very core of financial transparency and personal finance management. But what makes transaction details insightful and why do they matter so much?

Industry insights

The Reality of Building a Digital Bank

The total number of digital banking customers now stands at approximately 1.1 billion worldwide, and 20 neobanks now serve 10 million or more customers (and 39 with more than 5 million), placing several of them among the top 5 or 10 largest banks in their country. This article summarizes the best of "How to Build a Digital Bank", a detailed guide to building a digital bank, and insights from The Reality of Building a Digital Bank webinar. To complement this narrative and provide a real-world perspective, we present an article on the reality of building a digital bank.

Industry insights

How to Improve Banking App Store Reviews

For almost any app in the modern digital age, app store reviews are key to success. They serve as a public measure of your app’s quality and can significantly impact user acquisition and retention. Digital banking is no different. According to a survey by Alchemer, 77% of consumers read at least one review before downloading a free app, and 80% of users will not download an app if they see negative reviews about its performance.

Industry insights

Becoming the Bank of Choice: How to Stand Out From the Crowd

Switching banks is more common than one might think. According to a satisfaction survey conducted by J.D. Power, nearly 13% of consumers are expected to switch their primary bank this year. The most common reasons for this shift include high fees, poor customer service, lack of convenient digital banking features, and better offers from competitors. Is there a way to be a part of the client's life journey indefinitely? Let's find out.

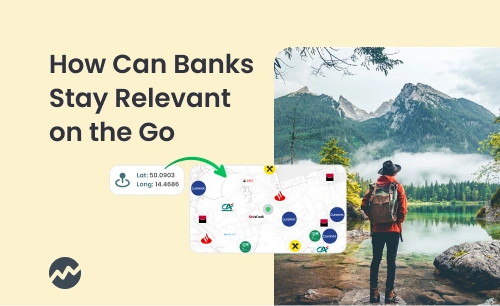

Industry insights

Banking on Travel: How Can Banks Stay Relevant on the Go

Travelling is becoming more popular and digital each year. According to a recent UNWTO survey, international tourist arrivals (overnight visitors) increased by 5% in 2023, reaching 1.4 billion travellers globally. As travel becomes more active, the role of digital banking is evolving accordingly to meet the needs of modern explorers. From seamless transactions to personalised financial services, digital banking is pushing the travel experience to a new level.

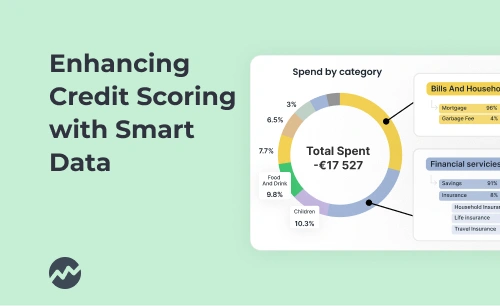

Product insights

Enhancing Credit Scoring with Smart Data: The Future of Financial Risk Assessment

For many decades, credit scoring has built the foundation of financial risk assessment and provided banks and other financial institutions with a quantitative view of a borrower's creditworthiness. Traditionally, credit scores are derived from a combination of factors that include payment history, credit utilization, the length of credit history, types of credit used, and recent credit inquiries. These data points offer a very narrow window into the financial behavior of a borrower and often lead to misjudgments in lending decisions. A modern answer to this is smart data. Or, more precisely, enriched data.

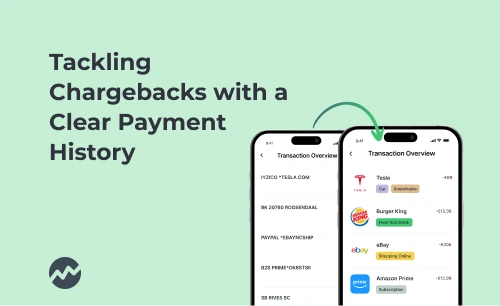

Product insights

Tackling Chargebacks in Digital Banking with a Clear Payment History

Chargebacks are an important tool providing clients with the ability to dispute transactions and reclaim funds. These happen when a client contacts their bank to reverse a transaction, often because they believe the transaction was unauthorized, fraudulent, or incorrect. Chargebacks themselves also present significant challenges for merchants, banks, and fintech companies, often resulting in substantial financial losses. And the rise of digital banking has only magnified the importance of efficient chargeback management. With many automation tools available, banks need to understand that prevention is often the cheapest and smartest option available, making clear payment history more important than ever.

Industry insights

Future Trends in Mobile Banking: Trends, Features and What's Missing in 2025

According to the German Mobile Banking App Review 2024, 60% of German consumers prefer using their banking app to manage their finances, with nearly one in three sending money via the app at least once a month. This shift towards digital solutions highlights the increasing trust and dependency on mobile banking, driven by both convenience and necessity. So, what are the most popular features that are available to users, and how is the digital market following trends in 2025?

Industry insights

A Comprehensive Guide for Banks to Ensure AI Act Compliance

Following the updates to the AI Act, it’s essential for banks to ensure their AI systems comply with these new regulations. This guide breaks down the process into manageable steps, making it straightforward for digital banking experts to follow and ensure compliance.

Industry insights

How to Build a Digital Bank in 2024

As digitalization progresses across markets, a new generation of banks is becoming increasingly popular. We are talking about digital banks, or neobanks, if you will. These banks operate entirely online, offering a suite of financial services without the need for physical branches. APIs, like those from the TapiX team, have been playing a major role in this shift, enabling seamless integration and functionality that enhance user experience and operational efficiency. Let's dive deeper into the process of building a digital bank in 2024.

Industry insights

The World of ATMs: Why cards and cash still go hand in hand

Automated Teller Machines have evolved significantly since their introduction in the 1960s. Initially designed to dispense cash outside banking hours, ATMs now offer a range of services, from depositing checks to transferring money between accounts. Today, there are over 3.5 million ATMs worldwide that are visited by users on average at least 8-10 times a month. Even cryptocurrency ATMs are on the rise, with more than 39 000 used worldwide.

Product insights

Why Developer Experience Matters in Transaction Data Enrichment

Developer experience (DX) is all about making tools and services easy to use, well-documented, and supportive of developers' needs. A positive developer experience leads to: - Faster Integration: Easy-to-use portals and clear documentation reduce the time required to integrate new services.- Fewer Errors: Detailed guides and examples help prevent common mistakes.

Industry insights

How are banks using AI in 2024

With the implementation of the EU AI Act providing a regulatory framework for ethical and responsible AI adoption, banks and financial institutions are starting to pay close attention. What exactly is AI used for in modern banking? Let's dive into different use cases and what it means for banks.

Industry insights

From Chatbots to Credit Scoring: How the AI Act Affects Banking

For the past several years, AI has captured the attention of many industries, including finance and banking, where it’s been helping institutions to automate many important services and solutions. In the meantime, the European Union has taken a significant step forward with the introduction of the EU AI Act.What exactly is the EU AI Act, and why does it matter? In this article, we'll introduce the basics to provide you with a comprehensive understanding before we explore its implications in more detail and check the AI readiness of the banking sector. According to Arizent survey, 56% of users would welcome the help ofAI in their financial recommendation services while 48% see it as a tool for evaluating credit or loan applications.

Industry insights

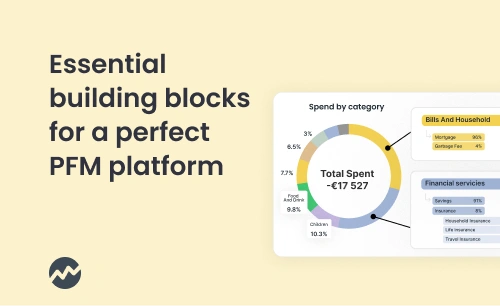

Bending data: Essential building blocks for a perfect PFM platform

With banking going digital and more personal than ever before, Personal Financial Management tools (PFM for short) have become indispensable for individuals seeking to take control of their finances. To build the perfect one...

Success stories

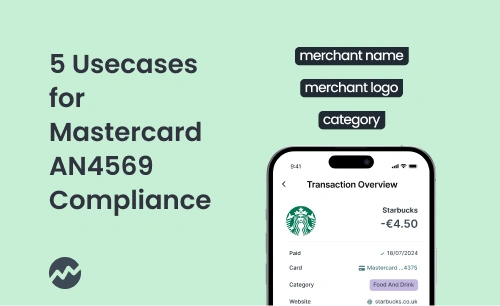

Swisscard chose Tapix to comply with Mastercard AN4569

Swisscard partnered with Tapix to comply with Mastercard AN4569, seizing the opportunity to redefine the user experience while meeting industry standards. As a key player in the financial sector, Swisscard recognized the importance of adhering to the stringent requirements of Mastercard AN4569 and chose Tapix as their solution partner. This strategic decision ensured compliance but also transformed the way their customers engage with transaction data.

Industry insights

Youth Banking Trends: Mapping Digital Banks for Kids, Teens, and Gen Z

While digital banking is undergoing a rapid transformation and growth, a new phenomenon is emerging – Kids Banking. This concept not only represents a revolutionary way for today's children to learn about money but also offers a unique opportunity to develop financial literacy from a very young age. Fintechs such as Pocket, GoHenry and neobanks such as Revolut are jumping on the trend.

Industry insights

7 Digital Banking KPIs Every Bank Should Focus On

Key Performance Indicators (KPIs) serve as crucial tools, allowing banks to measure how effective their digital banking apps are in engaging customers. In this guide, we'll explore seven essential customer success KPIs, complete with straightforward formulas, designed to help banks improve customer engagement, foster loyalty, and reduce churn rates.

Industry insights

Why Major Banks Struggle to Innovate: A Deep Dive into the Fintech-Bank Collaboration

Banks are at a crossroads between conservative survival or gradual implementation of new technologies and adaptation to their customers' requirements. Although they have considerable resources and a solid client base, they do not always manage to adapt in time. In this article, we will explore the key reasons for this and highlight the importance of building a spirit of innovation, engaging in technology development and partnering with fintech firms.

Product insights

Cash or card? Tapix launches ATM Nearby™ to help with cash withdrawals while traveling

Learn how Tapix's new ATM Nearby ™ solution can help you improve the user experience and overall client satisfaction with your application. The world might be becoming more digital by the day, yet in many countries across the globe, there are still around 3.5 million ATMs in operation.

Product insights

Why AI chatbots depend on high quality data: Garbage in, garbage out explained

Chatbots and digital assistants are one of the emerging trends in the digital banking industry. According to Juniper research, over 80% of banks are now using some form of chatbot in customer service. Lately, more and more banks are also starting to shift to more analytical usage, such as personal assistant, which reshapes the user experience, offering personalized financial advice and assistance at the touch of a button. But every good analysis needs a well structured and organised data first.

Industry insights

Beyond Transactions: Banks as Lifelong Partners - A Contextual and Marketplace Perspective

Modern banking is becoming more personalized than ever, thanks to strategies like contextual banking and marketplace banking. This article explores how these strategies are changing the way banks help clients in different stages of their lives – from student loans and discounts to mortgages and business loans.

Industry insights

How Gamification in Banking Is Levelling Up User Engagement in Mobile Apps

The concept of gamification, originating from the video game industry, has transcended into various fields of technology in the early 2000s as a novel marketing strategy. As banking apps and platforms continue to rise, gamification is reshaping how banks and fintech companies interact with their users, drawing valuable lessons from engaging video game experiences.

Industry insights

Personalisation in banking - the key to your customers’ heart

Customer expectations of their banking platform are evolving rapidly, especially when it comes to personal finances. As fintech firms continue to innovate, one trend is becoming very apparent: hyper-personalisation.

Product insights

Business Banking (SME) Features to Build on Payment Data

Discover how Tapix revolutionizes SME banking with innovative features like GPS transaction limits, EcoTrack for environmental responsibility, or automated approvals. In the world of small and medium-sized enterprises (SMEs), there is an increasing emphasis on efficiency and innovation in financial processes.

Product insights

What is vital for a perfect PoC and how to set the right expectations

Every project in the digital banking market begins with a solution capability check. A concept that helps financial companies find the best solution for a specific use case while cooperating with the data enrichment provider that is most suitable for their needs.

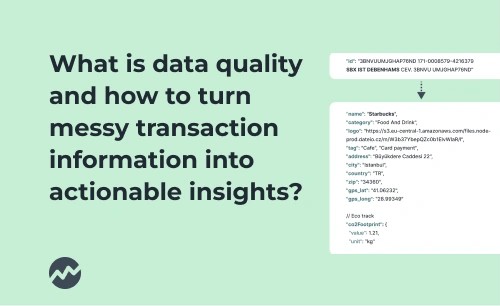

Product insights

What is data quality and how to turn messy transaction information into actionable insights?

Every transaction, every single tap with a credit card creates a stream of 0 and 1, and the ability to extract meaningful insights from that data is a key differentiator for banks and fintech companies.

Product insights

Why Allocating a Budget for Mastercard AN 4569 Compliance Is Crucial in 2024

Discover the strategic importance of allocating a budget for Mastercard AN 4569 compliance. Enhance user trust, mitigate risks, and gain a competitive edge in digital finance.

Product insights

In-house vs. Third-party Solutions for Mastercard AN4569 Compliance: Making the right choice

Explore the pros and cons of in-house development vs. third-party solutions for Mastercard AN4569 compliance. Make the right choice for your business's payment data enrichment journey.

Success stories

How Twisto better monitors expenses with Tapix

Twisto is a FinTech that enables their clients to shop now and pay later when it suits them. Thanks to the implementation of Tapix, Twisto users can additionally review their expenses and check where the purchase was made.

Industry insights

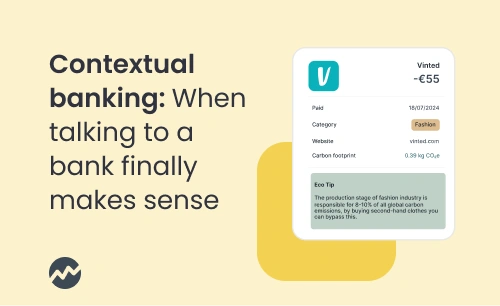

Contextual banking: When talking to a bank finally makes sense

Imagine a world where banks are not just a place you put your money, but they actually understand your needs. They speak in a way that makes sense and help you navigate your finances. If you ask any fintech enthusiast with over 20 bank accounts and a plethora of fintech platforms, they constantly explore and seek the most from their banking apps.

Product insights

Mastercard AN4569 Best Practice: Elevating User Experience with Visual Data Showcase

Enhance your user experience by meeting Mastercard AN4569 requirements. Elevate UI design, showcase visual data, and meet revised standards for enriched payment data

Product insights

5 Usecases for Mastercard AN4569 Compliance Beyond Minimum Requirements

Explore 5 use cases for Mastercard AN4569 compliance that go beyond minimum requirements. Unlock key insights for enhanced analytics, and customer-centric financial services.

Success stories

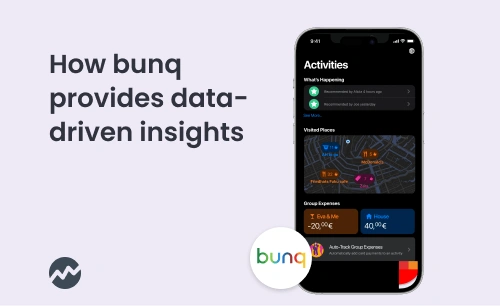

How bunq provides data-driven insights

bunq - the Dutch challenger bank was struggling to achieve a high coverage of merchant reconciliation. Learn more about how Tapix helped them through payment data enhancement.

Industry insights

What are MCC Codes and Why Banks Need More for Reliable Payment Categorisation

We decided to provide our insights into the power of strictly MCC-based categorisation and its limits. Categorisation is important for credit risk scoring and it is the basis for Personal Finance Management tools. When we analysed our categorisation with MCCs, we saw that only 53% of transactions could be easily and reliably categorised based on their MCC code. Let's look at the most frequent problems we identified that make MCC usage more difficult than it may seem at first glance.

Product insights

Mastercard AN4569 Compliance Guide for Banks

Discover essential strategies for banks to meet Mastercard mandate AN4569. Optimize compliance and get the most out of this requirement.

Product insights

Why Payment Data is the Key to Unlocking the New Value for Customers

In today's digital age, data is more than just information. It is a strategic asset that can unlock the immense value behind it. The aphorism that data is the gold of the 21st century applies here. One area where this trend is particularly evident is the world of payment data.

Product insights

Enhanced payment data with new Mastercard rules: nice-to-have? A must-have from October 2023!

Data is the most valuable commodity of the 21st century, and its importance is growing daily across industries. Finance and payments are good examples of this. Find out what the new Mastercard Mandate means for banks and fintechs.

Industry insights

Trends, Initiatives and the Future of Green Banking Products

The topic of global warming, long-term sustainability and overall respect for planet Earth has been discussed for decades, across human activities and industries. Today, there is little doubt that climate change poses a real and significant political and economic risk to humanity.

Industry insights

What does Generation Z expect from banking?

Everly and Tapix joined forces to organize a panel on the topic of Future of Banking: Gen Z. Join us for an exciting online discussion with speakers from W1tty, MyMonii, Gimi & Lunar on the 7th of December at 4PM CET. In this article we provide highlights regarding the Gen Z Banking landscape

Success stories

Tapix EcoTrack launched in bunq app

In an exciting move towards promoting sustainable practices and empowering users to make eco-conscious decisions, bunq has successfully integrated Dateio's latest product, Tapix EcoTrack, into its banking app. This integration marks a significant step forward in fostering collaboration between two industry leaders and revolutionizing the way consumers engage with their carbon footprint.

Success stories

Tapix Expands into LATAM and Fuels Astropay Payment Platform with Enhanced Data Insights in a Record Time

Tapix, the leading Czech fintech company renowned for its innovative payment data enrichment solution, is thrilled to announce its expansion into the LATAM region fulfilled in record time of 6 weeks from first chat to launch. This strategic move comes on the heels of remarkable success in other markets, and it further strengthens Dateio's commitment to enhancing user experiences and driving data-driven insights in the banking and fintech industry.

Industry insights

Why do non-bank issuers offer credit cards?

The market for digital lending from non-bank credit card issuers and fintech firms is becoming increasingly popular among consumers. It is a modern and innovative form of financing that provides a faster and more accessible alternative to traditional methods. The long queues at bank branches have come to an end. Customers want a loan in a few clicks and they want a card full of benefits to go with it. The BNPL trend with players like Klarna, Zip and Twisto shows this.

Industry insights

Sustainability in Digital Banking: Trends and the Crucial Roles of Banks and Consumers

Sustainability is becoming an increasingly key issue in digital banking, both from the perspective of consumers and from the standpoint of banks reflecting their interests as well as their ESG strategy. The interest also reflects a growing awareness of the climate change we are facing. In this article, we take a detailed look at why green direction and green thinking in banks and their banking applications are coming to the foreground now.

Success stories

Tapix brings enriched payment data to the Reflect App

Today, Tapix is excited to announce its partnership with Reflect, the first neobank in Jordan. This partnership will bring Tapix's enriched payment data to Reflect's App users, providing a better customer experience and better control of their money. Enriched payment data brings valuable insights into customer behavior, which can help banks like Reflect offer better services to their users.

.webp)

.webp)

.webp)

.webp)