Perspectives du secteur

Les meilleurs influenceurs de la banque numérique et des fintech à apprendre

Le secteur des technologies financières peut être un endroit bondé. Àmesure qu'il continue de croître et d'évoluer, il devient plus important quejamais de rester à jour sur les dernières tendances et innovations. LinkedInest une mine d’or pour découvrir des leaders d’opinion influents quifournissent des informations précieuses, des nouvelles et des idées quifaçonnent le secteur.

Success stories

5 façons dont les principales banques utilisent l'enrichissement des transactions bancaires

Quand les banques traitent l'enrichissement des transactions comme une réflexion a posteriori, tout ce qui est en aval se brise. Des idées de dépenses ? Génériques au mieux. L’empreinte carbone ? Approximative. Le respect des normes ? Douloureux. Des litiges ? Sans cesse. Et chaque chef de produit connaît l’effet domino : une faible confiance des données signifie des utilisateurs désengagés, un faible NPS et un taux de désabonnement plus élevé.

Perspectives du secteur

Comment les API bancaires numériques transforment la finance en 2026

À mesure que la banque devient plus numérique, le besoin de simplification et d'automatisation devient plus évident. Une partie importante de cette situation conduit à l'adoption d'API dans le secteur bancaire. Alors que les API (Application Programming Interfaces) existent depuis longtemps, la montée en puissance actuelle de la banque numérique est motivée par la demande de solutions de paiement en temps réel, les avancées de la réglementation bancaire ouverte et la nécessité d’un engagement client renforcé.

Aperçus des produits

Exigences de Visa pour fournir des données commerciales enrichies aux titulaires de carte

Visa a annoncé une série de mandats mettant à jour la façon dont les banques et les fintechs gèrent les données de transactions, les contrôles des titulaires de cartes et les paiements récurrents. Ces changements font suite à des mesures réglementaires similaires prises par Mastercard et visent à améliorer la transparence, la confiance des consommateurs et le contrôle numérique dans l'écosystème européen des paiements.

Perspectives du secteur

Au-delà de la banque : rapprocher les paiements, le jeu et la personnalisation

La banque se dégourdit les jambes. Sa mission principale pourrait être encore les soldes et les factures, mais ce sont aussi les téléphones, les données de voyage, la culture du jeu, l’épicerie, et même les stands de sport. En Europe, les changements les plus intéressants sont pratiques, un peu ludiques, et étonnamment utiles. Ils se trouvent là où les paiements rencontrent l'identité et où les données transforment les dépenses en un service très personnel.

Perspectives du secteur

Les coûts cachés de la construction de solutions internes d'enrichissement des données

Sur le papier, construire vos propres solutions d'enrichissement de données semble judicieux. Vous disposez d’ingénieurs compétents, d’une équipe de data science décente et d’une feuille de route qui semble le permettre. Mais voilà : l’enrichissement des données transactionnelles n’est pas seulement un projet technique, c’est un projet en constante évolution. Et pour de nombreuses banques et fintechs, ce qui commence comme une solution miracle se transforme en passif à long terme.

Perspectives du secteur

Outils d'enrichissement des transactions en temps réel : questions clés

Les données de transaction ne sont précieuses que lorsqu’elles sont claires et utilisables. Cela aide les banques et les fintechs à transformer les chaînes de paiement brutes en informations significatives que les clients peuvent instantanément reconnaître – améliorant la confiance, l'expérience et l'engagement. Voyons cela plus en détail.

Aperçus des produits

Communication bancaire hyper personnalisée : transformer les données en temps réel en conversations pertinentes

La plupart des gens savent quand un message ne leur était pas destiné. Un message générique « Nous avons une offre exceptionnelle pour vous » est facile à ignorer. Les messages qui réagissent à ce qu'une personne fait réellement (cette semaine, ce matin, parfois cette minute) résonnent différemment. Ils paraissent utiles.

Aperçus des produits

Comment une catégorisation des transactions plus intelligente permet de meilleures opérations bancaires

La façon dont nous traitons les transactions financières a beaucoup évolué. Les paiements sans contact, les portefeuilles mobiles et les applications bancaires uniquement numériques ont redéfini ce que signifie gérer de l'argent. Malgré tous les progrès technologiques, de nombreuses banques ont encore du mal dans un domaine important : catégoriser les transactions efficacement. C’est essentiel pour presque tous les services bancaires numériques.

Aperçus des produits

Pourquoi L’Hyper-Personnalisation Définit Désormais le Succès de la Banque Numérique

Les attentes des clients en matière de banque numérique ont évolué de manière assez significative ces dernières années. Fini le temps où «Bonjour, Alex» et un modèle de suggestion d'économies vous semblaient impressionnants. Aujourd'hui, les consommateurs en veulent plus. Ils veulent se sentir compris. Pas seulement en tant que titulaires de comptes, mais en tant que personnes réelles avec des habitudes financières complexes, des ambitions et des angoisses. Il est temps de se mettre à l’hyper-personnalisation.

Perspectives du secteur

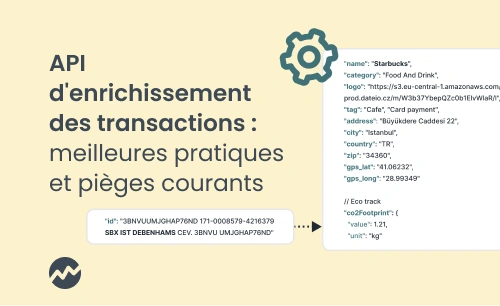

API Pour L’enrichissement Des Transactions : Meilleures Pratiques Et Pièges à Éviter

Nous avons déjà abordé en détail l'enrichissement des transactions, c'est-à-dire la manière dont les données de paiement brutes et chaotiques sont nettoyées et rendues significatives. Mais cette fois, nous l'abordons sous un angle différent. Si vous envisagez d'intégrer une API d'enrichissement dans votre entreprise ou si vous souhaitez simplement savoir comment fonctionne l'API dans le contexte de la banque numérique, cet article vous servira de guide.

Perspectives du secteur

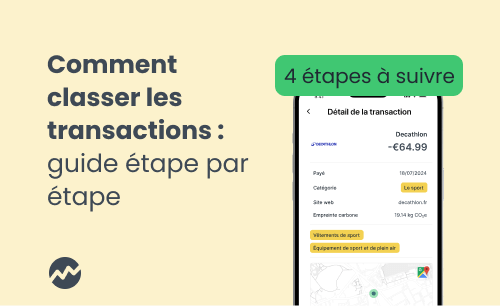

Bien Catégoriser Les Transactions : Notre Guide Étape Par Étape

Si vous avez déjà regardé un relevé bancaire et vu des chaînes de données chaotiques, vous n'êtes pas le seul. Les clients attendent de la clarté. Ils veulent savoir ce qu'ils ont dépensé, où et pour quoi. D'un autre côté, le backend doit savoir comment traiter les données correctement pour que les deux parties soient satisfaites.

Aperçus des produits

Pourquoi le Nom et le Logo du Marchand Dans Les Services Bancaires Numériques Comptent Plus Que Vous ne le Pensez

Vous faites défiler votre application bancaire, en essayant de vous rappeler ce qu’était cette facture de 33 $. La ligne indique « ESO ESSENCE TURDA DEP ». C'était le déjeuner ? Un covoiturage ? Quelqu'un a cloné votre carte ? Vous cliquez. Vous cherchez sur Google. Finalement, vous renoncez, ou pire, vous appelez le service client.

Perspectives du secteur

La Banque Responsable Dans Les Règles De L’art: Top 5 Des Banques et Leur Leadership

Ces dernières années, de plus en plus de banques et d'institutions financières se sont concentrées sur la durabilité en tant qu'élément central de leurs opérations. Ce virage vers une banque responsable (également appelée banque éthique) est surtout une réponse aux défis mondiaux pressants du changement climatique, des inégalités sociales et de la dégradation de l’environnement.

Perspectives du secteur

Innovations en banque mobile : Le rôle de l’UX et de l’UI dans la banque numérique de nouvelle génération

Le secteur financier a connu une transformation assez radicale au cours de la dernière décennie, la banque mobile devenant une interface majeure entre les banques et leurs clients. Comme le souligne une étude récente de Branch, le secteur des applications mobiles connaît une croissance importante depuis plusieurs années et cette tendance s’étend au secteur financier.

Aperçus des produits

Comment détecter les jeux de hasard dans les banques numériques

Ça commence souvent petit. Un client transfère de l'argent sur son compte Skrill – rien d'anormal. Juste une simple transaction dans le contexte d'une journée bancaire autrement calme. Mais quelques heures plus tard, ce même paiement est acheminé dans un casino en ligne, masqué par un code de catégorie de commerçant générique. En surface ? Innocent. En coulisses ? Risque potentiel.

Aperçus des produits

Paiements récurrents en banque numérique: comment passer du chaos à la clarté

Plus nous passons au numérique, plus nous devons suivre les services en ligne, les abonnements et les paiements récurrents, car ils font partie intégrante de notre vie quotidienne. Des plateformes de streaming aux stockages cloud en passant par les abonnements fitness mensuels et les paiements en voiture, ces transactions automatisées offrent commodité, mais elles ont un coût. Sans données précises sur les transactions présentées de manière conviviale, leur gestion devient un défi financier, tant pour les consommateurs que pour les institutions bancaires.

Perspectives du secteur

Décodage : l'ABC de l'enrichissement des données transactionnelles

Avez-vous déjà assisté à une réunion ou à une conférence, hochant la tête alors que des experts de l'industrie se démènent autour de termes et d'abréviations qui ressemblent à une langue étrangère? Cela peut paraître excessif, surtout dans le monde financier, où les termes et l'argot évoluent rapidement.

Perspectives du secteur

Au-delà des codes MCC : Pourquoi la catégorisation précise des transactions est l’avenir des banques

Les codes de catégories de commerçants (MCC), initialement conçus comme une norme universelle pour la catégorisation des transactions, ont longtemps servi de référence pour la classification des transactions dans le secteur bancaire.

Perspectives du secteur

Comment les données façonnent l’avenir de l’expérience utilisateur dans les banques

L'expérience utilisateur (UX) va aujourd'hui au-delà d'une interface agréable ou d'une application facilement utilisable. Il s'agit de rendre les données exploitables, intuitives et applicables dans n'importe quelle interaction réalisée par l'utilisateur.

Aperçus des produits

Comment les banques devraient travailler avec les données de transaction

Pour qu’une plateforme bancaire numérique fonctionne bien, les données de transaction doivent aller au-delà d'une simple liste de paiements.

Perspectives du secteur

Comment construire une banque numérique en 2024

À mesure que la numérisation progresse sur tous les marchés, une nouvelle génération de banques est de plus en plus populaire. Nous parlons de banques numériques, ou néobanques, si vous voulez.

Success stories

De Google à Revolut : Mariia Lukash sur la croissance de la banque digitale dans les PECO

Aujourd’hui, j’ai eu le plaisir de m’entretenir avec Mariia Lukash, Responsable Croissance de Revolut pour les PECO, une véritable puissance de la fintech avec plus de six ans d’expérience dans la stratégie numérique et la croissance.

Aperçus des produits

Le coût de l’inexactitude des données dans la banque numérique

Avec la technologie qui progresse lentement, les données commencent à être au cœur de chaque transaction, décision et stratégie au sein de la banque. Qu’il s’agisse de recommander des produits financiers aux utilisateurs ou d’automatiser les processus décisionnels...

Perspectives du secteur

Les plus grands mythes de la banque numérique brisés

La banque numérique a considérablement progressé mais,comme dans tout autre secteur, de nombreux mythes et idées fausses subsistent.Celles-ci nuisent souvent à la compréhension et limitent l'adoption denouvelles technologies et de moyens de mettre à niveau les services bancairesnumériques.

Perspectives du secteur

Top 5 des fonctionnalités bancaires numériques pour la génération Z

Née à l’ère du numérique, la génération Z exige plus de son expérience bancaire que les générations précédentes. Découvrez les fonctionnalités les plus utilisées et les plus demandées.

Aperçus des produits

Pourquoi l'enrichissement des transactions est-il important pour gagner la course à la banque numérique ?

Nous utilisons tous des données améliorées chaque jour, souvent sans nous en rendre compte. La fonctionnalité de saisie automatique de Google, par exemple, repose sur l'amélioration des données pour offrir aux utilisateurs une expérience de recherche plus intelligente.

Perspectives du secteur

Pourquoi les codes MCC n'aident pas (beaucoup) à catégoriser les paiements

Nous avons décidé de donner notre point de vue sur la puissance d'une catégorisation strictement basée sur le MCC et ses limites. La catégorisation est importante pour la notation du risque de crédit et constitue la base des outils de gestion des finances personnelles. Lorsque nous avons analysé notre classement avec les MCC, nous avons constaté que seulement 53 % des transactions pouvaient être classées facilement et de manière fiable en fonction de leur code MCC. Examinons les problèmes les plus fréquents que nous avons identifiés et qui rendent l'utilisation du MCC plus difficile qu'il n'y paraît à première vue.

Perspectives du secteur

5 tendances numériques dans les banques pour PME en 2024

Alors que nous discutons quotidiennement au Club bancaire des PME de sujets liés à la numérisation des banques des PME – au cours de nos webinaires, publications sur les sites Web et interviews, dans cet article, j’ai résumé les principaux sujets auxquels les principales banques de la région de l’Europe centrale et orientale réfléchissent actuellement.

Perspectives du secteur

Sur la vague verte : Tendances, initiatives et avenir des banques vertes

Le thème du réchauffement climatique, de la durabilité à long terme et du respect général de la planète Terre est discuté depuis des décennies, dans le cadre des activités humaines et des industries. Aujourd'hui, il ne fait aucun doute que le changement climatique représente un risque politique et économique réel et important pour l'humanité.

Perspectives du secteur

Qu’attend la génération Z de sa banque ?

Everly et Tapix ont uni leurs forces pour organiser un panel sur le thème du futur de la banque : Génération Z. Joignez-vous à nous pour une discussion en ligne passionnante avec des conférenciers de W1tty, MyMonii, Gimi & Lunar le 7 décembre à 16h CET. Dans cet article, nous présentons les principaux faits concernant le paysage bancaire de la génération Z

Perspectives du secteur

Des chatbots à l’évaluation des risques-crédits : Comment la loi sur l'IA affecte les banques

Depuis plusieurs années, l’IA attire l’attention de nombreux secteurs, notamment la finance et la banque, où elle aide les institutions à automatiser de nombreux services et solutions importants. Dans l'intervalle, l'Union européenne a fait un pas important en avant avec l'introduction de la loi européenne sur l'IA.

Perspectives du secteur

Développement durable dans la banque numérique : Tendances et rôles cruciaux des banques et des consommateurs

Le développement durable devient un enjeu de plus en plus important de la banque numérique, tant du point de vue des consommateurs que du point de vue des banques reflétant leurs intérêts ainsi que leur stratégie ESG. Cet intérêt reflète également une prise de conscience croissante des changements climatiques auxquels nous sommes confrontés. Dans cet article, nous examinons en détail les raisons pour lesquelles l’orientation écologique et la pensée verte dans les banques et leurs applications bancaires sont maintenant mises en avant. Nous réfléchirons aux principales différences entre une banque réellement durable et le greenwashing. Nous examinerons également les initiatives actuelles qui travaillent sur le marché pour promouvoir la durabilité dans le secteur bancaire.

Perspectives du secteur

Stimuler l'engagement des utilisateurs : 6 façons efficaces d'augmenter les utilisateurs actifs pour une meilleure utilisation des applications bancaires

Les banques ont de nombreuses raisons de motiver leurs clients à utiliser plus souvent leurs applications mobiles. Premièrement, cela peut augmenter la rentabilité car les banques peuvent proposer leurs produits et services directement sur l'application. Deuxièmement, l’amélioration de l’expérience client (par exemple, en améliorant les données de paiement) ou l’augmentation de l’efficacité sont d’autres raisons pour lesquelles les banques souhaitent que les clients utilisent l’application.

Perspectives du secteur

7 KPI sur lesquels chaque banque numérique devrait se concentrer

Les indicateurs clés de performance (KPI) sont des outils essentiels, permettant aux banques de mesurer l'efficacité de leurs applications bancaires numériques pour engager les clients. Dans ce guide, nous explorerons sept indicateurs clés de réussite client essentiels, assortis de formules simples, conçus pour aider les banques à améliorer l'engagement des clients, à les fidéliser et à réduire les taux de désabonnement.

Perspectives du secteur

Services bancaires pour mobiles en 2025 : Tendances, fonctionnalités et ce qui manque

Selon l’étude allemande Mobile Banking App Review 2024, 60% des consommateurs allemands préfèrent utiliser leur application bancaire pour gérer leurs finances, près d’un sur trois envoyant de l’argent via l’application au moins une fois par mois.

Perspectives du secteur

7 tendances bancaires numériques à surveiller en 2025

Le secteur bancaire évolue rapidement, motivé par le besoin de rapidité, de personnalisation et de sécurité. À mesure que nous avançons, quelques tendances clés façonnent déjà l’avenir du secteur financier, la technologie jouant un rôle majeur dans la façon dont les banques répondent aux attentes des clients.

Aperçus des produits

Guide de conformité Mastercard AN4569 pour les banques

Début 2021, Mastercard a introduit une règle pour ses émetteurs européens de cartes connue sous le nom de AN 4569 - Revised Standards for the Display of Enhanced Merchant Data.

Perspectives du secteur

Services bancaires pour enfants : Cartographie des banques numériques pour les enfants, les adolescents et la génération Z

Alors que la banque numérique connaît une transformation et une croissance rapides, un nouveau phénomène émerge : les services bancaires pour enfants. Ce concept représente non seulement une façon révolutionnaire pour les enfants d'aujourd'hui d'apprendre l'argent, mais offre également une occasion unique de développer des connaissances financières dès leur plus jeune âge.

.webp)

.webp)

.webp)

.webp)